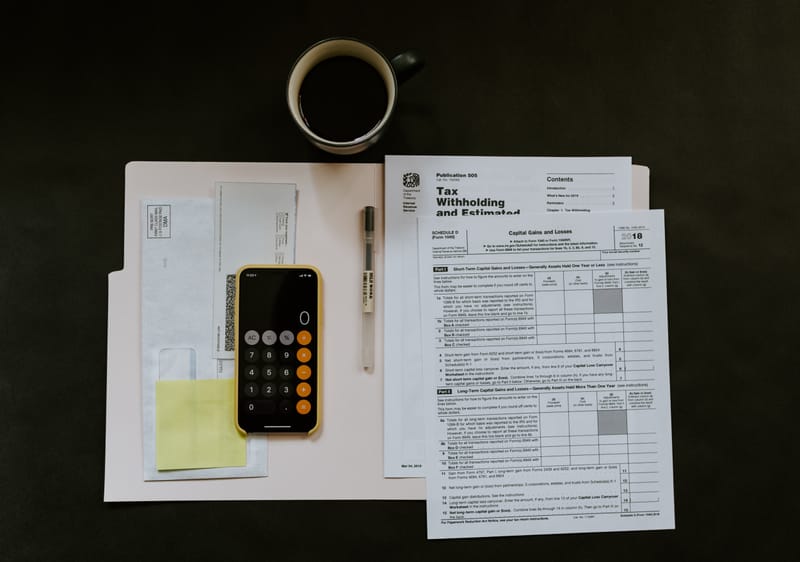

Tax Planning

We will work closely with you to develop and implement various strategies in order to minimize your tax liability, in turn providing more financial freedom for you and your family.

Tax analysis

We will help you understand tax strategies and your personal tax liability. For example, some taxes can be deferred, and others can be managed through tax-efficient investing. With careful and consistent preparation, we will help you to manage the tax impact on your financial efforts. We will holisticly review your current financial situation, including prior tax returns, current financials and future goals.

Tax planning

Planning is the key to successfully and legally reducing your tax liability. We will create and implement a financial plan in order to maximize your after-tax income and evaluate alternatives strategies to meet your financial goals.

Tax preparation

Preparing your own tax return can be a task that leaves you with more questions than answers. Even if you use a computer software program, there's no substitute for the assistance of an experienced tax professional. We will:

- Review all of your financial documents

- Prepare your tax return, schedules, and required forms

- File electronically ensuring a quicker refund

IRS representation

In the event of an audit, we will work and communicate with the IRS on your behalf.